|

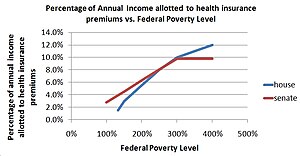

| English: House Bill and Senate Bill subsidies for health insurance premiums. (Photo credit: Wikipedia) |

|

| US residents with employer-based private health insurance, with self insurance, with Medicare or Medicaid or military health care and uninsured in Million; U.S. Census bureau: Income, Poverty, and Health Insurance Coverage in the United States: 2007 (Photo credit: Wikipedia) |

|

| English: Created by vectorizing Image:Medicare and Medicaid GDP Chart.png with Inkscape (Photo credit: Wikipedia) |

SOURCE

Clients often seek our advice about whether additional assets may be preserved, either for the spouse, or as an inheritance for the children. This is information that Medicaid is not going to share with you when you apply. Many clients come to us discouraged because they have heard of the “look back” period, which limits giving gifts to family members in the five years before someone applies for Medicaid. Essentially, Medicaid tries to discourage gifts by penalizing those who make gifts by finding them ineligible for Medicaid for a period of time.

SOURCE

It is important to recognize that each family is different, and there may be exceptions to the penalties on gifts during the look back period. For example, there are no penalties, so no waiting period before one can get Medicaid, if the transfer is to a disabled child even if that child is an adult. The rules which penalize transfers of the home do not apply to transfers to a minor or disabled child, to a “caregiver” child who has lived in the parent’s home and cared for him or her for at least two years, or to a sibling who also has an ownership interest in the home. Other helpful methods to preserve assets include paying off the mortgage or other debts, making home improvements, and prepaying funeral expenses for both spouses. In certain instances, purchasing an annuity may be appropriate.

SOURCE

There is a lot of bad information out there from those who mean well but may be misinformed. The best way to explore how this area of law applies to your family is to meet with an elder law attorney.

No comments:

Post a Comment